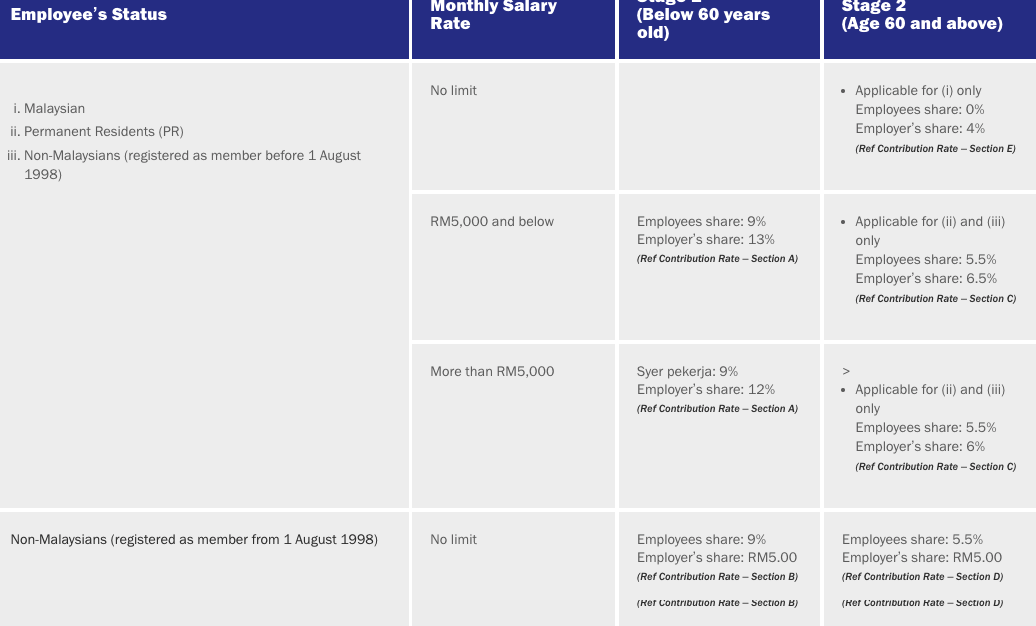

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. 6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998 No limit.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third ScheduleMonthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

. The standard practice for EPF contribution by employer and employee are. 65 Ref Contribution Rate Section C More than RM5000. Employees Provident Fund EPF.

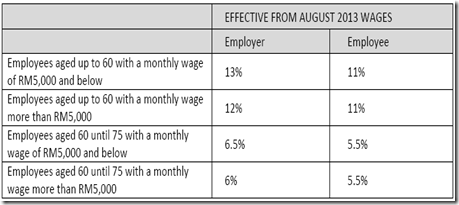

The department is responsible in ensuring every employer remits EPF contributions on behalf of their employees in accordance with the EPF Act 1991. Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. YOUR ONE-STOP EMPLOYER FACILITY.

The monthly wages of Malaysians aged 60 and over and non-Malaysians of any age do not affect the employers EPF contribution rate. An application has to be made with a Borang KWSP 17A Khas 2021 form via the employer in question. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 300 600.

KWSP 7 Borang E Schedule of Contributions Arrears. In addition the EPF contribution rate is vary according to your monthly salary rate. 65 Ref Contribution Rate Section C More than RM5000.

6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998 No limit. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

Lets have a view of table here. Despite employees being able to submit the Borang KWSP 17A Khas 2021 form as early as 01122020 employers are only allowed to upload VEKHAS2021 csv file on i-Akaun Employer starting from 14122020. 12 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

Employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location. KWSP EPF Contribution Rates. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings.

The arrangement of EPF is allowing employees that over year of 60 are still productive and active towards the economy and their country. EPF contribution rate shown in the EPF table does not apply to foreigners registered as EPF members before August 1 1998. Get the right form you need right here.

When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings. Should an employee choose to remain at 11 contribution rate theyll need to fill up Borang KWSP 17A Khas 2021 which will then be submitted to EPF by their respective employer. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021.

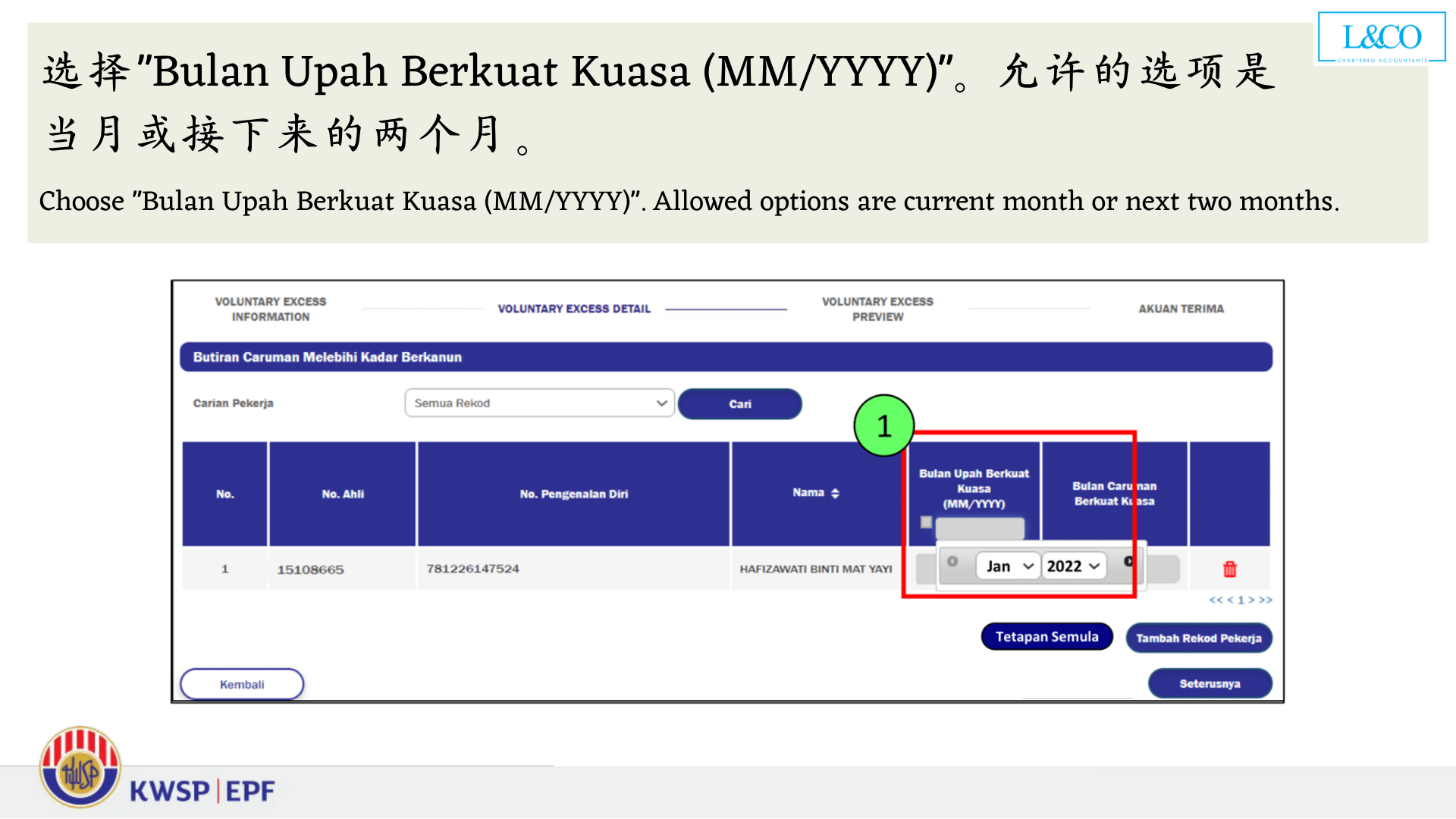

The application for employees to contribute above the statutory rate will be in effect from January 2021 wages OR for wages on the month. The employer is responsible to contribute the employees share by deducting the employees salaries and the employers share. During the tabling of the Budget 2022 themed Keluarga Malaysia Makmur Sejahtera the Minister of Finance Tengku Datuk Seri Zafrul Tengku Abdul Aziz announced that the Governments 15 per cent contribution under i-Saraan subject to a maximum of RM250 per member per year will be extended to include those from age 55 to 60.

EPF Contribution Rates for Employees and Employers. However the registration form only asks for a copy of the passport ID page and does not request the other items mentioned above the bureaucrats at the Tax Office ask for them as a matter of course. Kumpulan Wang Simpanan Pekerja KWSP is a federal statutory body under the purview of the Ministry of FinanceIt manages the compulsory savings plan and retirement planning for private sector workers in MalaysiaMembership of the EPF is mandatory for Malaysian citizens employed in the private sector and voluntary for non.

This savings is comprised of the members and employers shares of the contributions plus the yearly dividends. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL. Since 2020 the default.

This department also ensures that employees interest are well taken care of through effective and comprehensive complaint management. Wages StatementSalary Slip shall include the following. Their employers have to remains 4 a month contribution instead of previous 13 a month.

Registration Updates. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Based on the Contribution Rate within the Third Schedule the employers contribution should be RM756 12 while the employees contribution stands at RM567 9.

If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Employer Employee Contribution RM RM RM RM RM From 22001 to 24000 3200 2700 5900 From 24001 to 26000 3400 2900 6300. This brings the total monthly EPF contribution to RM1323.

Effective from April 2020 salarywage up to December. The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016. Employers EPF contribution rate.

The contribution amount of employer and employee shares shall be based on the Contribution Rate Third Schedule of the EPF Act 1991. This savings is comprised of the members and employers shares of the contributions plus the yearly dividends. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age.

12 Ref Contribution Rate Section A Applicable for ii and iii only Employees share. Employees EPF contribution rate. For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12.

SQL Payroll software ready with all malaysia government report EPF Borang A SOCSO Borang 2 SOCSO Borang 3 SOCSO Borang 8A EIS Borang 1 EIS Borang 1A EIS Borang 2 EIS Borang 2A EIS Lampiran 1 Income Tax CP39 CP39A Income Tax CP 39A Income Tax CP 22 Income Tax EA Form Income Tax EC Form Income Tax CP 8 CP 159 Income Tax e Data Praisi Income Tax. Employer Employee Contribution RM RM RM RM RM From 12001 to 14000 1900 1300 3200 From 14001 to 16000 2100 1500 3600 From 16001 to 18000 2400 1700 4100. Employers NPWP photograph Authorization letter authorizing your representative to register and handle your tax matters.

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

Epf Contribution Rates 1952 2009 Download Table

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

20 Kwsp 7 Contribution Rate Png Kwspblogs

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Sql Account Estream Hq Employee Epf Contribution Rate From 11 Reduced To 7 Effective From 1 April 2020 To 31 December 2020 Employer Epf Current Contribution Rate Not Change To

20 Kwsp 7 Contribution Rate Png Kwspblogs

Confluence Mobile Support Wiki

Epf Change Of Contribution Table Ideal Count Solution Facebook

Confluence Mobile Support Wiki

Epf Contribution Table 2021 How To Calculate Your And Your Employera S Epf Contribution

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Download Employee Provident Fund Calculator Excel Template Exceldatapro

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Epf Interest Rate From 1952 And Epfo

Steps To Apply Employee S Epf Contribution Rate At 11

Epf Contribution Rates 1952 2009 Download Table

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4